What if you could predict the future of crypto prices — not with luck, but with the power of math and machine learning?

This article explores how to combine ARIMA models with genetic algorithms for more accurate crypto forecasting. ARIMA helps model time-series patterns like trends and seasonality, while genetic algorithms optimize ARIMA parameters for better signal accuracy and robustness in volatile markets.

What Are Genetic Algorithms?

Genetic Algorithms (GAs) are inspired by natural evolution. Rather than manually testing every possible setting for a model, GAs evolve the best solution over time using a process that mimics biological selection.

How Genetic Algorithms work in 6 key steps?

- Population – A group of candidate solutions (in this case, ARIMA models with different settings).

- Fitness Evaluation – Scoring reflects each model’s performance.

- Selection – The process selects the top-performing models for reproduction.

- Crossover – Parts of selected models are combined to create new “offspring.”

- Mutation – Random small changes are introduced to add diversity.

- Iteration (Epochs) – The process is repeated over multiple generations to refine results.

Each cycle, called an epoch, helps the models evolve and improve their accuracy.

What Is ARIMA?

ARIMA stands for Auto Regressive Integrated Moving Average — a popular statistical method used for forecasting time series data, such as cryptocurrency prices.

Three parameters define an ARIMA model:

- p (AutoRegressive terms) – Uses past values to predict future ones.

- d (Integrated) – Removes trends by differencing the data.

- q (Moving Average terms) – Accounts for past prediction errors.

For example, an ARIMA(1,1,1) model uses:

- 1 previous time step (AR),

- 1 differencing step (I),

- 1 moving average term (MA).

ARIMA is highly effective for modeling financial time series data — but selecting the right p, d, and q parameters manually can be challenging.

How Genetic Algorithms Optimize ARIMA for Crypto Forecasting

Now let’s look at how we can use Genetic Algorithms to automatically find the best ARIMA settings for predicting cryptocurrency prices.

Step-by-Step Process

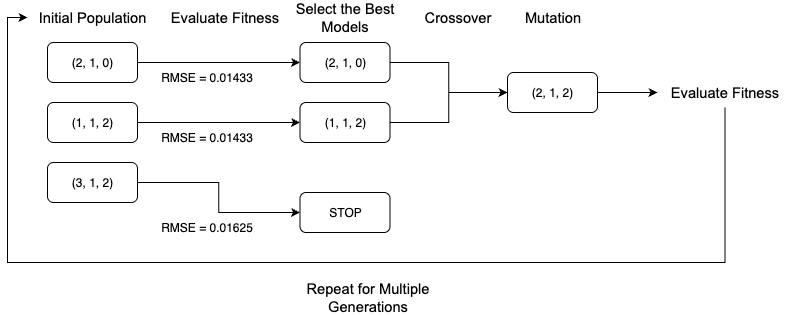

1. Generate an Initial Population

Start with a random group of ARIMA models, each with different combinations of (p, d, q).

Examples:

- (2,1,0)

- (3,1,2)

- (1,1,2)

2. Evaluate Fitness

Each model is tested on historical price data using metrics like:

- Mean Absolute Error (MAE)

- Root Mean Square Error (RMSE)

- Model complexity vs. accuracy trade-off

The lower the error, the better the model.

3. Select the Best Models

The algorithm selects the top-performing models for reproduction.

4. Crossover

Two high-performing models are combined to produce a new child model. For instance:

- Parent A: (2,1,0)

- Parent B: (1,1,2)

- Child: (2,1,2)

5. Mutation

Introduce small, random changes (e.g., changing q from 2 to 0) to avoid getting stuck in local optima and to maintain diversity.

6. Repeat for Multiple Generations

This cycle continues for 10–50 epochs. Each iteration helps the population evolve, leading to improved accuracy and more optimized ARIMA configurations.

The Result

By the end of the process, the Genetic Algorithm discovers the best-performing ARIMA model for the given cryptocurrency dataset — without manual trial and error.

Why This Matters for Crypto Investors and Data Scientists

In volatile markets like crypto, accuracy in prediction is everything. Combining ARIMA with Genetic Algorithms offers:

- Automated model optimization

- Improved forecasting accuracy

- Efficient parameter tuning without manual testing

This approach isn’t just theory — it’s a practical tool for traders, data scientists, and anyone building predictive models for Bitcoin, Ethereum, or altcoins.

Final Thoughts

ARIMA forecasting, when combined with Genetic Algorithms, becomes a powerful solution for predicting cryptocurrency price trends. It blends statistical modeling with machine intelligence to optimize results — and it’s a huge leap beyond guesswork.

Want to see this in action with Python and real crypto data? Let us know in the comments, and we’ll create a full tutorial!