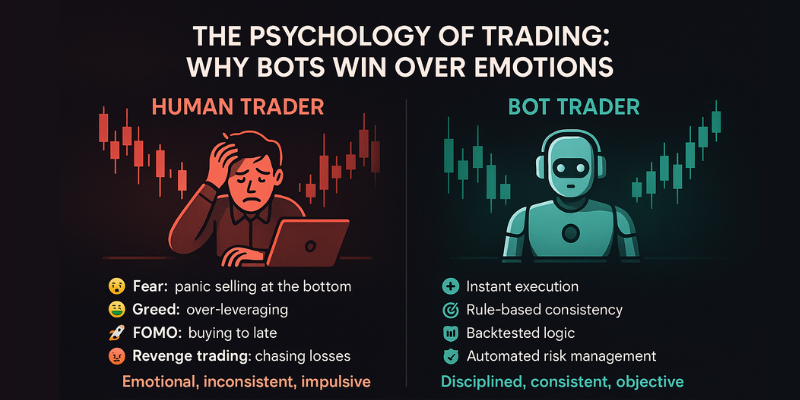

Crypto trading isn’t just about charts, indicators, and strategies, it’s also about psychology. Human emotions often interfere with decision-making, leading to impulsive moves that hurt performance. This is where trading bots like Junglebot shine: they operate with discipline, consistency, and zero emotional bias.

In this article, we will look at how emotions like fear, greed, and FOMO (fear of missing out) often lead traders to make bad decisions. Bots eliminate emotional trading by executing strategies automatically, providing consistency, discipline, and better risk management.

The Psychology Behind Trading Decisions

Trading is as much a mental game as it is a financial one. The market’s volatility triggers strong psychological responses that can override logic.

Common Emotional Traps:

- Fear of Missing Out (FOMO): Buying late into a rally.

- Greed: Over-leveraging to chase bigger gains.

- Fear: Panic-selling at the bottom.

- Revenge trading: Trying to win back losses too quickly.

These behaviors often result in buying high and selling low, the opposite of a profitable strategy.

Read more about: “Trading psychology: How fear, greed & FOMO affect your decisions”

Why Bots Outperform Human Psychology

Trading bots are not smarter than humans, but they are more disciplined. They follow pre-programmed rules without hesitation.

Key Advantages of Bots:

- Emotion-Free Execution – Bots don’t panic during a crash or get greedy in a rally. They simply follow logic.

- Consistency & Discipline – Humans second-guess strategies, but bots stick to rules, trade after trade.

- Faster Reaction Time – Markets move in milliseconds. Bots execute instantly, while humans hesitate.

- Backtesting and Logic-Based Decisions – Bots can be trained on historical data, ensuring strategies are statistically tested.

- Risk Management Automation – Bots apply stop-loss and take-profit orders without hesitation, reducing emotional bias.

Use Case: Emotional Trading vs Bot Trading

Scenario: Bitcoin suddenly drops 8% in one hour.

- Human Trader: Panics, sells at the bottom to “cut losses,” then buys back higher, locking in a loss.

- Bot Trader: Recognizes the dip as part of volatility, executes a pre-set buy at support, and exits with profit when price recovers.

This example highlights how emotions amplify losses, while bots maintain objectivity.

How Bots Help With Long-Term Success

While no system can guarantee profits, bots can dramatically improve a trader’s consistency and risk-adjusted returns over time. They:

- Reduce impulsive mistakes

- Improve risk-adjusted returns

- Allow for round-the-clock execution in 24/7 crypto markets

- Free up mental energy so traders can focus on strategy instead of reacting emotionally

Good practice: Combine human strategy with bot execution. You design the plan, the bot ensures flawless discipline.

Final Thoughts: The Role of Bots in Trading Psychology

The greatest enemy of any trader is often not the market, but their own mind. Fear, greed, hesitation, and overconfidence can destroy even the most promising strategy. Trading bots act as a safeguard against these psychological pitfalls, ensuring that discipline – not emotion, drives execution.

In a market as volatile as crypto, success often comes down to consistency. By combining human creativity with the discipline of automated bots, traders can maximize their chances of long-term profitability while keeping emotions out of the equation.