Before undertaking the development of profitable trading, forecasting, or signal-processing strategies. One must know whether a time series means reverting, random walk in nature, or trending. The Hurst Exponent (H), named after British hydrologist Harold Edwin Hurst, is a statistical formula used to measure the long-term memory of time series data. It is an invaluable tool for traders, analysts, and researchers developing mean-reverting strategies.

What is mean reversion?

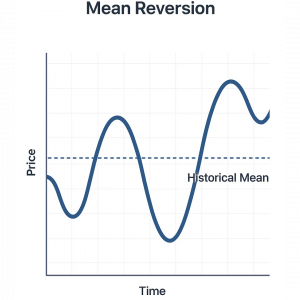

Mean reversion is a theory. It states that a variable like a stock price, interest rate, or exchange rate will return to its historical mean over time. This statistical trait suggests that large moves in one direction are often reversed. Prices tend to shift back toward the mean. This creates chances to exploit temporary mispricings in financial markets.

In financial markets, traders’ strategies based on mean value involve buying assets when their prices are low and selling them when they are high. The idea is that prices will eventually return to their average level. However, not all assets behave this way. It’s useful to know whether a price tends to return to the mean. This is where the Hurst Exponent comes in. It helps determine whether an asset usually returns to the mean, follows a trend, or moves randomly.

The Hurst exponent (H) explained

Hurst Exponent is also a measure of long-term statistical dependence of time series data. It describes the behaviour of the series thus:

- H < 0.5: The time series is negatively autocorrelated and mean-reverting. A decline becomes increasingly probable after an increase, and vice versa.

- H = 0.5: The time series is geometric Brownian motion or a random walk, and there is no discernible predictability or autocorrelation to be found.

- H > 0.5: The time series is persistent or trending and shows positive autocorrelation—trends continue longer than they reverse.

Why long-term memory in time series matters?

The idea of long memory or persistence in time series is that the effect of past values does not die out after some time but continues to influence future values forever. This is the opposite of white noise or memoryless processes. In practice:

- Mean-reverting series are negatively autocorrelated: If prices go up today, they will go down tomorrow, and vice versa.

- Long-memory processes will have more discernible patterns on long-time horizons, which will be exploitable for prediction and strategy formation.

- Strong mean-reverting financial instruments may be an indicator of market inefficiencies that will be exploitable by expert traders.

Example use of hurst exponent in financial trading

- Pairs Trading: The Hurst exponent (H < 0.5) can help identify pairs of assets with a spread that tends to return to its average, indicating potential mean-reverting behaviour.

- Statistical Arbitrage: By analyzing asset combinations with cointegration and mean-reversion characteristics (often reflected in low Hurst values), the Hurst exponent supports the detection of long-term equilibrium relationships.

- Volatility Strategies: The Hurst exponent can help identify when volatility is likely to return to normal. This insight can be used to spot short or long opportunities in volatility-related assets.

Advantages of using the Hurst exponent

- Reveals the level of predictability in a time series.

- Helps distinguish between mean-reverting and trending behaviour.

- Improves risk assessment by highlighting when randomness assumptions may be misleading.

Conclusion

The Hurst Exponent offers a mathematically founded approach to determine mean-reverting potentiality of time series data. From creating an algorithmic trading model to conducting financial analysis or merely grasping market dynamics, incorporating Hurst-based analysis offers immense understanding of the long-range memory characteristics of data.

A well-designed mean reversion approach, grounded in Hurst Exponent analysis and supported by statistical verification, can be a source of consistent returns and a reliable complement to a diversified trading portfolio.