If you’re exploring crypto trading, investing, or experimenting with automated trading using a crypto trading bot, you’ve probably come across the term market capitalization or market cap for short. But what does it actually mean, and why does it matter so much in the world of cryptocurrencies?

Let’s break it down and connect it to trading strategies, risk management, and tools like trading bots.

What is crypto market capitalization?

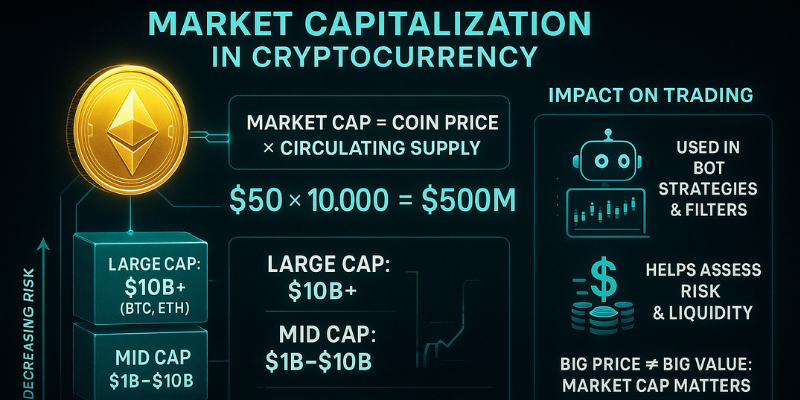

In simple terms, market capitalization in the crypto world is the total value of all coins of a cryptocurrency in circulation. It’s calculated like this:

Market Cap = Current Coin Price × Total Circulating Supply

Example:

If a coin trades at $50 and there are 10 million coins in circulation:

Market Cap = $50 × 10,000,000 = $500 million

This figure helps you understand how big—or potentially stable—a cryptocurrency is relative to others in the market.

How market cap is classified in crypto

Large-cap cryptocurrencies

- Typically have market caps over $10 billion

- Examples: Bitcoin (BTC), Ethereum (ETH)

- Often considered more stable and lower risk—but still volatile compared to traditional assets

Mid-cap cryptocurrencies

- Market caps between $1 billion and $10 billion

- Tend to offer higher growth potential but with increased volatility

Small-cap cryptocurrencies

- Market caps under $1 billion

- High-risk, high-reward potential

- Frequently targeted for speculative strategies or by newer crypto trading bots seeking volatility

Why market cap is important for crypto traders

Whether you’re trading manually or using automated software, market cap is a crucial metric:

1. Measures relative size and popularity

Market cap offers a quick snapshot of how significant a coin is in the broader crypto market. For example:

- Bitcoin is the market-cap leader and heavily influences overall market sentiment

- Lower-cap coins can be more vulnerable to sudden “pump-and-dump” schemes

2. Enables risk management

Traders often diversify portfolios by market cap:

- Large caps for stability

- Mid and small caps for growth potential

This balance is fundamental to sound crypto trading strategies, even when developing a trading bot.

3. Impacts liquidity

Large-cap coins generally have:

- Higher trading volumes

- Tighter bid-ask spreads

These factors are essential for automated trading and cryptobots, which rely on liquidity to execute trades efficiently without getting stuck in illiquid markets.

4. Impacts bot strategies

Crypto trading bots often factor market cap into decisions such as:

- Which tokens to include in trading

- Position sizing

- Risk thresholds

For example, a bot might avoid low-market-cap tokens if liquidity is too thin for its trading strategies.

Market cap vs. price: don’t be deceived

Many beginner traders mistakenly equate a coin’s price with its value. For instance, a $0.50 token might have a larger market cap than a $100 token if its circulating supply is vastly higher.

That’s why experienced traders—and reputable crypto trading platforms—focus on market cap, not just price, when evaluating opportunities.

Market cap and bots for trading

Market cap is highly relevant to anyone using bots for trading because:

✅ It helps identify liquid markets suitable for live trades

✅ It prevents bots from getting trapped in illiquid positions

✅ Many cryptobots automatically screen out low-market-cap coins to reduce risk

If you’re designing your own crypto trading strategies, integrating market cap as a metric can make your automated trading both safer and potentially more profitable.

Final thoughts

Market capitalization is one of the most important numbers in crypto. It:

- Measures a coin’s overall value

- Helps traders assess stability and risk

- Guides both manual and automated crypto trading decisions

Whether you’re a long-term investor or running a crypto trading bot on your favorite crypto trading platform, understanding market cap gives you a significant edge in this fast-paced market.

Tip: Knowledge is your strongest asset in crypto—often more powerful than even the fastest trading bot or smartest cryptobot.