If you’re new to crypto trading, you’ve probably seen pairs like BTC/USDT or ETH/BTC and wondered what they mean. Understanding trading pairs is essential for executing trades, managing risk, and navigating exchanges efficiently.

A crypto trading pair shows which two currencies are being exchanged. The first currency is the base currency, and the second is the quote currency. Reading pairs correctly helps traders understand prices, calculate profits, and choose the right trades.

What are Trading Pairs in crypto?

A trading pair in crypto represents the value of one asset relative to another. Essentially, it tells you how much of the quote currency is needed to buy one unit of the base currency.

Structure of a Trading Pair

- BTC/USDT: Bitcoin (BTC) is the base currency, Tether (USDT) is the quote currency.

- Price indicates how many USDT are required to buy 1 BTC.

- If BTC/USDT = 60,000, 1 BTC costs 60,000 USDT.

Common Types of Trading Pairs

- Crypto-to-Fiat (e.g., BTC/USD, ETH/EUR)

- These pairs allow you to trade cryptocurrencies against traditional currencies.

- Useful for entering or exiting crypto positions.

- Crypto-to-Crypto (e.g., ETH/BTC, ADA/ETH)

- These pairs show the value of one crypto relative to another.

- Often used for altcoin trading without converting to fiat.

- Stablecoin Pairs (e.g., BTC/USDT, ETH/USDC)

- Stablecoins are pegged to fiat (USD), reducing volatility.

- Common for trading and hedging risk in volatile markets.

How to Read Trading Pairs

1. Base Currency

-

The first currency in the pair.

-

Example: In BTC/USDT, BTC is the base.

2. Quote Currency

-

The second currency in the pair.

-

Shows the value of the base currency in terms of the quote.

-

Example: If BTC/USDT = 60,000 → 1 BTC = 60,000 USDT.

3. Price Movement

-

When the price rises, the base currency gains value relative to the quote.

-

When the price falls, the base currency loses value relative to the quote.

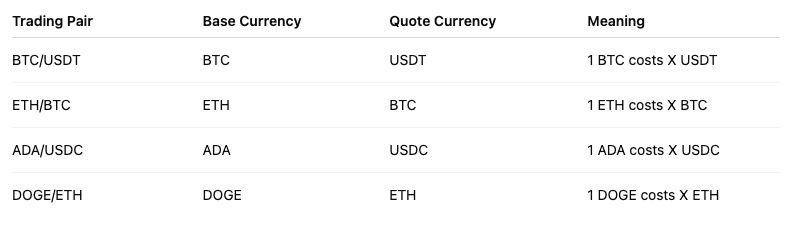

Examples of Popular Trading Pairs

Why Trading Pairs Matter

- Price Clarity – You know exactly how much of one asset is needed to acquire another.

- Trading Flexibility – Allows direct swaps between cryptos without converting to fiat.

- Liquidity Considerations – Popular pairs (BTC/USDT) generally have higher liquidity and lower spreads.

- Strategic Trading – Traders can exploit arbitrage, hedge risk, or rotate between assets efficiently using pairs.

Tips for Beginners

- Start with stablecoin pairs (BTC/USDT, ETH/USDT) to understand price movements.

- Check liquidity before trading altcoins — low liquidity pairs can cause slippage.

- Use charts and historical data to analyze trends within a pair.

- Be mindful of fees, especially when trading multiple pairs to rotate positions.

Final Thoughts

Understanding crypto trading pairs is the first step toward confident trading. Whether you’re trading BTC for USDT or swapping altcoins, reading the base and quote currencies correctly ensures you make informed decisions. Pair knowledge also helps in strategy development, risk management, and navigating exchanges like a professional.

Read our article and learn more about slippage in crypto trading – its causes and how to avoid it.