Market volatility is one of the defining features of the crypto industry. Prices can swing dramatically within minutes.

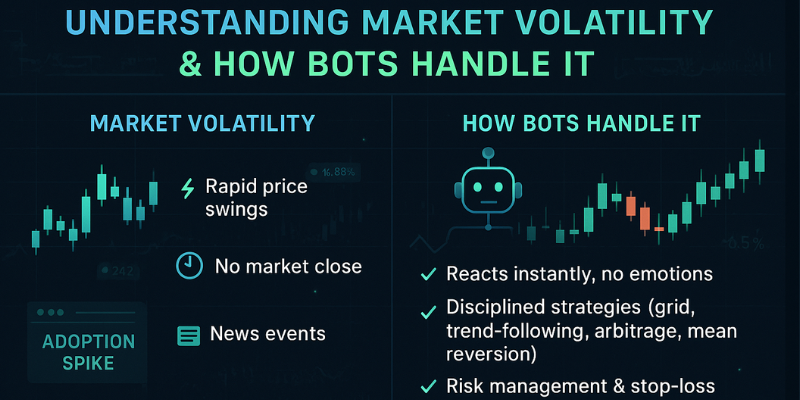

In this article, you will learn how crypto’s wild price swings create both risk and opportunity and how trading bots like Junglebot turn volatility into an advantage. You’ll discover what drives volatility, why it matters to traders, and how bots use speed, discipline, and risk management to react faster than humans. From grid and trend-following strategies to arbitrage and mean reversion, the article also covers the benefits, risks, and best practices of using bots in volatile markets.

What Is Market Volatility in Crypto?

For traders, volatility can be intimidating, but for trading bots, it’s an environment where automation can truly shine. With features like stablecoin handling, bots can lock in profits or pause activity when swings intensify (see “What are stablecoins and how to use them strategically”). Moreover, by eliminating emotional factors like fear and FOMO, bots help maintain disciplined execution even when markets panic (see “Trading psychology: How fear, greed & FOMO affect your decisions”). On the technical side, methods like ARCH/GARCH allow bots to sense and quantify volatility, enabling smarter strategy adaptation. And you can always monitor how your bots perform during these periods for better insight and control (“Track your bots like a Pro: How to monitor performance in Junglebot”).

Volatility describes the degree of price fluctuation in a given time period. In crypto, this is often extreme compared to traditional markets due to:

- 24/7 trading – no market close

- Low liquidity in smaller coins

- News-driven moves (regulation, hacks, adoption)

- Speculative trading behavior

For example, Bitcoin can swing 10% in a single day, something rarely seen in stocks or forex.

Why Volatility Matters to Traders

High volatility creates profit opportunities but also elevates risk.

Pros of Volatility:

- More entry and exit points

- Higher profit potential for active traders

- Opportunities in both bull and bear moves

Cons of Volatility:

- Sudden liquidations in leveraged trades

- Increased emotional trading mistakes

- Harder to set reliable stop-loss levels

How Junglebot Handles Market Volatility

In Junglebot you can connect your exchange, choose your strategies, and let multiple bots monitor the market 24/7, without giving up control of your funds.

Here’s how Junglebot thrives in volatile conditions:

- Reacts Faster Than Humans

Junglebot executes trades instantly, no hesitation, no emotions, ensuring you don’t miss opportunities in fast-moving markets. - Pre-Programmed, Disciplined Strategies

Instead of panic selling or chasing FOMO, Junglebot sticks to logic. Its automation ensures trades are executed based on the rules you set. - Risk Management & Control

Unlike some platforms, Junglebot never holds your funds, you keep them on your exchange. This transparency and control help reduce risks. - Multiple Bots for Multiple Markets

With support for over 90 coins (BTC, ETH, SOL, XRP, ADA, DOGE, and more) across two major exchanges, Junglebot can diversify your trading strategies in real-time.

Types of Bot Strategies for Volatile Markets

Grid Trading Bots

- Place buy/sell orders at set intervals.

- Profit from sideways volatility.

Trend-Following Bots

- Use moving averages and MACD to ride strong moves.

Arbitrage Bots

- Exploit price differences across exchanges.

Mean Reversion Bots

- Bet on prices returning to average after extreme swings.

Risks of Using Bots in Volatile Markets

- Over-optimization – Bots may fail in new conditions.

- Technical errors – API or exchange downtime can cause losses.

- Leverage risks – Bots with high leverage can liquidate quickly.

That’s why bots must be monitored and paired with strong risk management.

Final Thoughts: Volatility + Bots = Opportunity

Crypto volatility can be overwhelming for human traders but is ideal for trading bots that thrive on speed, consistency, and automation. While no bot eliminates risk, they provide structure and discipline, two crucial factors when navigating wild price swings.