In crypto trading, profits are built on discipline, not luck. Even the best strategy can fail without proper risk management tools. That’s why Stop-Loss and Take-Profit settings are crucial, especially in automated trading. They protect your portfolio from large drawdowns while ensuring you lock in gains during volatile market moves.

Stop-loss and take-profit orders are automated tools that close trades at predefined price levels. They protect traders from big losses and secure profits automatically – key elements for risk control in crypto trading bots.

What Are Stop-Loss and Take-Profit Orders?

Stop-Loss

A Stop-Loss order automatically closes a position when the market price reaches a specified level below your entry.

- Goal: Limit downside risk.

- Example: You buy BTC at $60,000 and set a stop-loss at $57,000. If price drops there, your bot sells automatically to prevent further loss.

Take-Profit

A Take-Profit order does the opposite – it closes a position when your target profit is reached.

- Goal: Lock in gains without manual intervention.

- Example: You set a take-profit at $63,000. If BTC hits that price, your position closes automatically with a 5% profit.

These tools allow traders, and especially bots, to manage trades with logic instead of emotion.

Why They’re Essential in Automated Trading

Automated systems execute trades instantly, but without proper exit rules, even AI bots can overexpose positions or miss reversal points. Stop-loss and take-profit mechanisms ensure every trade has a clear risk/reward ratio.

1. Prevents Emotional Decisions

Human traders often move stops or cancel them out of fear or greed. Bots, however, follow logic strictly, no hesitation, no second-guessing.

2. Protects Capital During Volatility

Crypto markets can move 10% in minutes. Automated stop-loss ensures one bad trade doesn’t wipe out your portfolio.

3. Secures Profits Automatically

Take-profit rules prevent traders from “holding too long.” Once the target is hit, profits are locked and capital is free for the next setup.

4. Defines Risk Before Entry

Every strategy should have a clear risk/reward ratio — e.g., risking 1% to gain 3%. Bots apply this logic systematically, avoiding inconsistent trade sizing.

Smart Stop-Loss Strategies

- Trailing Stop-Loss

Moves upward as the asset’s price increases — protecting profits in trending markets.

Example: If BTC rises from $60K to $62K, the trailing stop moves from $58K to $60K. - Dynamic Stop-Loss Based on Volatility

Adapts automatically using indicators like ATR (Average True Range).

Helps prevent premature exits during normal fluctuations. - Percentage-Based Stops

Fixed risk per trade (e.g., 2%) — simple and effective for most strategies.

Optimizing Take-Profit Levels

- Multiple Profit Targets

Bots can split positions — taking partial profit at +3% and the rest at +6%.

This balances safety and opportunity. - Indicator-Based Exits

AI bots can close trades when momentum fades (e.g., MACD crossover or RSI reversal). - Risk/Reward Ratios

A standard professional setup is 1:3, risking 1% to gain 3%.

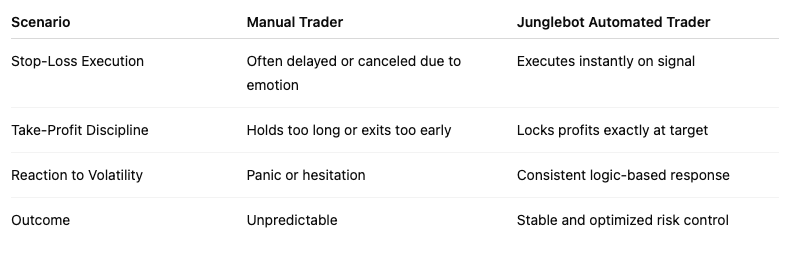

Use Case: Manual vs Automated Protection

This comparison shows how automation enforces discipline — the key to sustainable growth in crypto trading.

Final Thoughts: Protect Before You Profit

In crypto, profits come from control, not prediction. Stop-loss and take-profit orders form the backbone of a disciplined, automated system. Whether you’re using a simple DCA bot or an advanced AI-powered system like Junglebot, these tools protect your capital, preserve gains, and allow long-term compounding without emotional interference.

Trading psychology: How fear, greed & FOMO affect your decisions