Spot trading and futures trading are two of the most popular methods for participating in the crypto markets. Understanding the difference between them is essential for both beginners and experienced investors aiming to build smart strategies.

At a Glance: Spot vs Futures Trading

Spot trading involves buying and selling actual cryptocurrencies, while futures trading allows you to speculate on price movements without owning the asset. Each approach has unique benefits, risks, and use cases depending on your investment goals.

What Is Spot Trading in Crypto?

Spot trading refers to the immediate exchange of a digital asset like Bitcoin or Ethereum at the current market price.

Key Features of Spot Trading:

- Ownership: You own the actual asset.

- Market price execution: Trades are settled instantly.

- No leverage (usually): Lower risk compared to futures.

- Popular platforms: Binance, Coinbase, Kraken.

Spot trading is ideal for long-term investors and beginners. It’s straightforward—when you buy BTC at $60,000, you now hold BTC, and its value fluctuates in your wallet.

What Is Futures Trading in Crypto?

Futures trading allows you to speculate on the future price of a cryptocurrency without owning the actual asset. These are contracts that agree to buy/sell an asset at a later date for a predetermined price.

Key Features of Futures Trading:

- No asset ownership: You trade contracts, not coins.

- High leverage available: Amplifies gains and losses.

- Hedging tool: Often used by professionals to manage risk.

- Types of contracts: Perpetual or fixed-date futures.

For example, if you think ETH will rise from $3,000 to $3,300, you can go long on an ETH futures contract. If correct, you profit from the price difference—sometimes magnified by leverage.

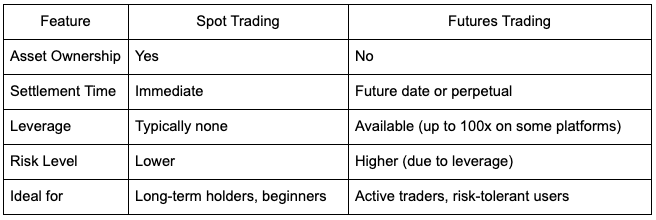

Spot vs Futures: Key Differences

Futures trading requires more experience due to volatility and margin risks, while spot trading is often safer for those starting out in crypto.

Pros and Cons of Each Approach

Spot Trading Pros:

- Easy to understand and execute

- Suitable for holding and long-term investing

- No liquidation risk

Spot Trading Cons:

- No leverage = lower profit potential

- You only profit when prices go up

Futures Trading Pros:

- Leverage can increase gains

- Shorting allows profit in downtrends

- Useful for hedging portfolios

Futures Trading Cons:

- Higher risk and complexity

- Possibility of liquidation and margin calls

- Requires strict risk management

How to Choose: Spot or Futures?

Choosing between spot and futures depends on your risk tolerance, experience level, and investment goals.

Ask Yourself:

- Do I want to own crypto assets or just speculate?

- Am I ready to handle leverage and fast-paced markets?

- Am I trading short-term trends or investing long-term?

Final Thoughts: Spot vs Futures Trading in Crypto

Both spot trading and futures trading play crucial roles in the crypto ecosystem. Spot is better for straightforward investing and long-term holding. Futures, while riskier, offer opportunities for savvy traders to profit in both bull and bear markets.