Welcome to the future of automated crypto trading

If you’re reading this article – congratulations! You’ve just taken your first step toward smarter and faster crypto trading. In this guide, we’ll walk you through the process of creating your account and introduce you to Junglebot – a powerful crypto trading platform designed for anyone who wants to automate their trades with zero stress and full control.

Whether you’re a complete beginner or a seasoned trader exploring crypto bot trading and algorithmic strategies, this guide will show you exactly how to get started.

Step 1: Getting started

-

Create an account and finish the onboarding process

Enter your email address and a secure password to create your account. Once you create an account you will be redirected to the onboarding page. Here, you’ll be asked to provide some basic information to help us create your user profile. Take a moment to review our “Terms and Conditions”. Scroll to the bottom of the page and click the ”I agree to these Terms” button to continue.

-

Set the fire

We’d like to show you how the Junglebot platform works. At this step, you can take advantage of a 14-day free trial period. No commitments. Choose your subscription package and click “Subscribe” to proceed. Don’t hesitate – the sooner you finish the setup, the more time you’ll have to explore Junglebot.

Step 2: Connect your exchange

-

Choose either Binance or Coinbase

Next, you’ll be asked to select a crypto exchange to connect with Junglebot for trading. Right now, Junglebot supports connections with Coinbase and Binance – two of the biggest, most trusted crypto exchanges worldwide. You can connect both. If you don’t have an account with one of our supported exchanges, no worries. You can create one directly by selecting your preferred exchange and following the link.Your exchange is the place where you deposit your funds for trading and the place from which you can withdraw them. Junglebot doesn’t hold any assets or funds — they remain in your exchange wallet.

It’s a good idea to have different portfolios in the exchange especially if you plan to trade with Junglebot and also make trades on your own. The main reason is that if you manually convert or trade an asset that the bot has acquired, Junglebot won’t be aware of the change, which may disrupt its strategy or tracking.

You can start trading with as little as 20 USDC and build your portfolio in stable assets on a monthly basis. You can always add additional funds to your e-wallet on the exchange at any time. Adding funds allows the bot to open additional positions and expand your portfolio based on your strategy, especially when market conditions are favorable.

-

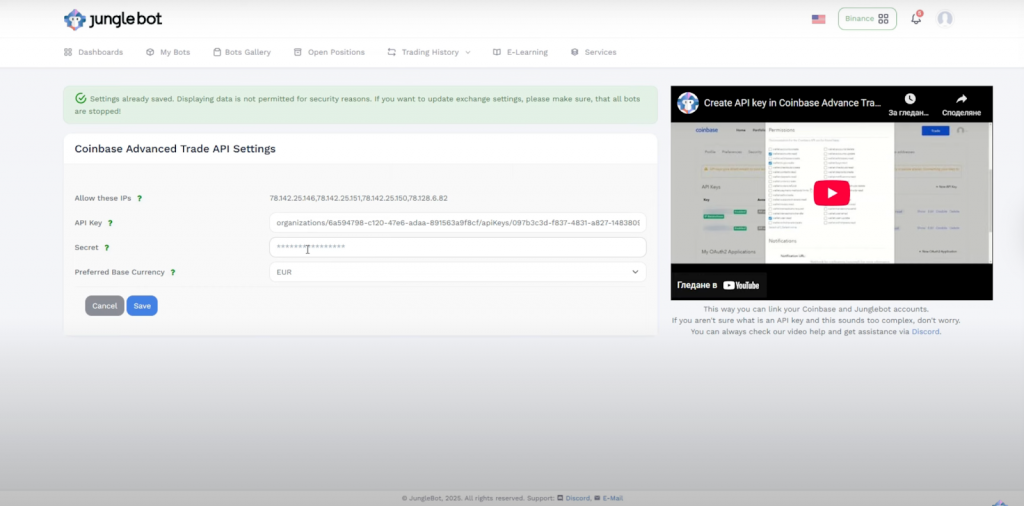

Create an API key from your exchange

If you are wondering “Why do I have to link my crypto exchange account to Junglebot?” – the simple answer is: Because that’s how the magic happens! By connecting to your exchange, Junglebot helps you automate trading actions based on market conditions — but you’re always in control of the strategy and decisions.

Keep in mind that your funds must be in the Spot Wallet ор Portfolio linked to the API key you’ve created. Otherwise, the bot will not be able to see or access the funds in that portfolio.

-

Link the API key to Junglebot

This secure connection allows Junglebot to place orders — with no access to withdrawal or transfer functions. It’s the bridge between your crypto trading automation and your exchange. Your funds remain safe and under your control. We use industry-standard encryption and never store your keys in plain text – your security is our top priority.

Follow our step-by-step instructions and learn how to create and connect your API keys.

Step 3: Set up your crypto trading bots

-

Select the bot type

Now comes the fun part. To create a new bot, navigate to the My Bots section. In the top right, click the green Create New button. A window will open, allowing you to select your bot type and configure its settings. Depending on your plan, you can:

-> Choose a Fixed Market Bot (this type of bot is available during your 14-day free trial) if you have a strong sentiment toward a specific market based on your own observations or analysis. Select it if you prefer to trade only on high-liquidity or low-liquidity markets or you want full control over which asset pair the bot trades.

-> Try the AI Trading Bot, which is a great choice if you want a more diversified portfolio of assets. It automatically monitors multiple markets and allocates funds based on performance and market conditions, helping reduce risk and increase exposure to different opportunities.

The main difference is that the Fixed Market Bot trades on a specific market, such as BTC/USDC. In contrast, the AI Bot monitors multiple markets simultaneously and ranks them based on market conditions, performance, and structure to determine where to trade, based on your selected strategy.

If you are wondering “Can I run multiple bots with different strategies at the same time?” The answer is: Yes! Feel free to mix, match, and run multiple bots simultaneously to diversify your trading game.

-

Customize your bot

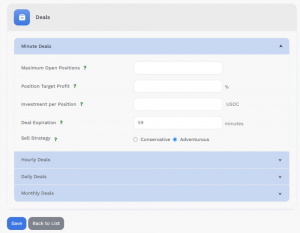

Each bot is customizable for your trading strategy. Once you’ve picked your bot type, let’s configure it.

-> Name the bot and give it an easily recognizable name.

-> Define your base and trade currency

-> Set deal types according to your preference. Minute, hourly, daily, or monthly they all have their purpose.

- If you’re a scalper, the most suitable deal types are “Minute Deals” and “Hourly Deals”.

- If you’re an intraday trader, consider using “Hourly Deals” and “Daily Deals”.

- If you’re a swing trader, then “Daily Deals” and “Monthly Deals” are more appropriate.

Deal Expiration is a special setting that is valid only if we set Conservative sell strategy and acts like a due date, after which we want the open positions to be closed. The main advantage here is that if for some reason the target profit cannot be reached—for example, in a sideways market where price fluctuation stays within a narrow range (e.g., [-1.3%; +1.3%])—then the position may either:

- Be closed when the target profit is finally reached,

- or Be closed earlier if the deal becomes old enough and the current profit is greater than 1.3%, even if it wasn’t the original target.

-> Specify the maximum number of open positions and the amount per position.

-> Configure strategies (conservative vs. adventurous), and track each bot’s behavior.

– With the Conservative sell strategy, the bot aims to sell at a specific target profit, such as 1.3%, as soon as that level is reached.

– With the Adventurous sell strategy, the bot aims to sell at 1.3% or higher, depending on market conditions, potentially holding longer to capture more profit if momentum is strong.

Finally, just click the Start button and be ready to explore the jungle.

If you need more assistance in this step you can find setup guides and video tutorials on the Help Page within the platform. Additionally, depending on your subscription package, you can also reach out to our support team at [email protected] for further assistance.

Step 4: Monitor performance and results

-

Bot’s performance

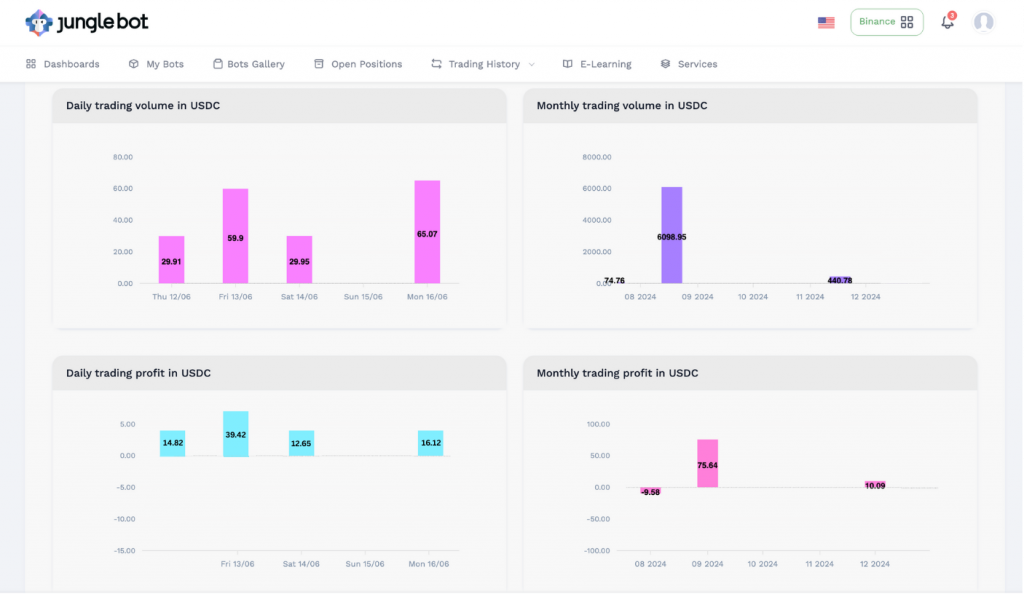

All setup is done and now it’s time to watch how bots are trading and to make optimisations if needed.

In the dashboard, you’ll find a complete and up-to-date overview of your bot’s performance. You can easily monitor how they are doing in real-time without having to check each one individually. All the necessary information is summarized in one place, including the total number of current open positions, profit for the last month, accumulated profit since the account was created, and the current investment.

Just beside the Main Page heading, you’ll find convenient submenus that allow you to view trading statistics by currency. These sections present aggregated data for all bots in the respective currency. You’ll be able to track daily and monthly trading volume and profit.

If you’re interested in tracking the performance of a specific bot, go to the My Bots section and click on the avatar icon of the selected bot. You’ll see detailed information, including bot settings and the status of current open positions. Next to the Details menu, you can explore the trading statistics such as:

- Volume and Profit

- Closed Positions History

- Orders placed at the exchange

-

Return of investment

One of the most asked questions is: What ROI should I expect? It depends on current market conditions, so there is no guaranteed or fixed return. Historically, returns may range from 0% to 20% annually, but this is not guaranteed. Past performance is not indicative of future results. Returns are variable and depend on many factors, including market sentiment and your chosen strategy

Monthly performance depends on the market conditions during that specific month. While the goal is to generate consistent returns, losses may occur, especially during long and persistent bear markets. It’s important to view performance over a longer time horizon, as short-term fluctuations are a normal part of trading.

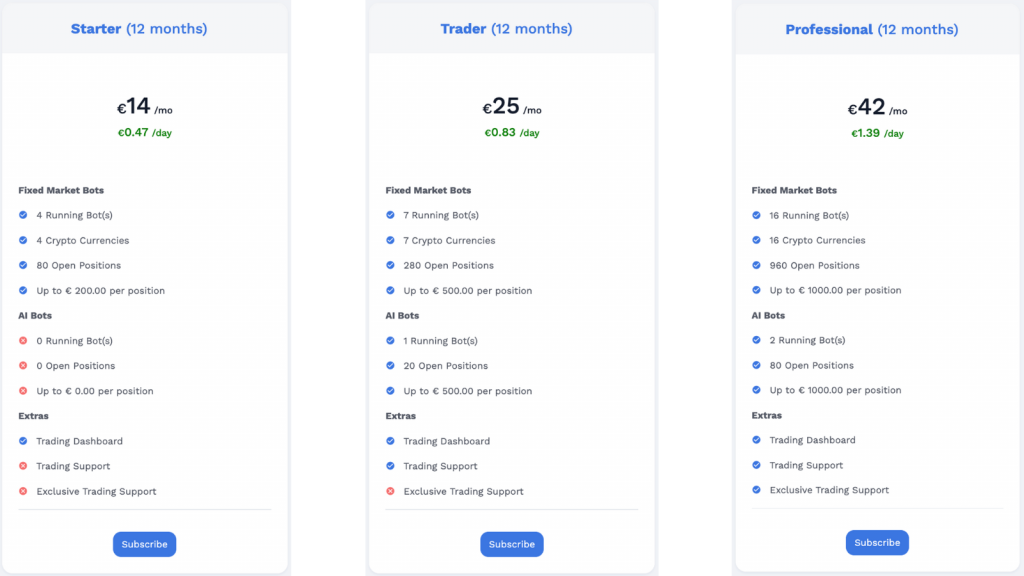

Step 5: Choose your Junglebot subscription plan

Free trials are fun, but real gains come when the jungle gets serious. After your free trial ends, you’ll still have access to your Junglebot account, but your bots will be stopped. To start them again, simply subscribe to one of our paid subscription plans. We charge a monthly fee based on how many bots you’ve got running. More active bots = higher plan.

Remember! Junglebot doesn’t take a cut from your trades. We do not have commission and hidden fees. We’re a software provider, not a broker and we have just a flat monthly fee for using the platform. Your exchange handles all trading fees, so check the rates on the selected exchange.

You can upgrade your subscription plan at any time. Just send us an email at [email protected], and our sales team will get in touch with you as soon as possible.

When your subscription expires your bots will stop automatically, but don’t worry, your trading history stays safe and accessible. You can still log in and review past activity anytime. Your bots will stay silent waiting for you to wake them up again.

What happens next:

With Junglebot, you get access to:

- Automated smart crypto trading, no coding needed

- Real-time portfolio monitoring

- Advanced trading powered by AI

- Fully transparent pricing — no hidden fees, no commissions

Now let’s trade like a beast. Once your bots are live, they begin working for you — 24/7. Enjoy your life beyond the charts

And if you ever hit a snag:

- Reach out via [email protected]

- Join our Discord community

- Use the Help Page for videos and tutorials

Get started now at www.junglebot.app

Let automation work for you — while you focus on what matters most.