Automation is transforming the crypto trading landscape. With markets running 24/7 and volatility at an all-time high, traders increasingly rely on trading bots to handle repetitive tasks, reduce emotional bias, and improve performance. Among the most popular types are Grid Bots, DCA Bots, and AI Bots.

Each has a distinct strategy, risk profile, and ideal use case. Understanding the differences helps traders choose the right tool for their market conditions and goals.

In this article we will walk through how Grid Bots profit from price swings within a range, DCA Bots lower risk by spreading buys over time, and AI Bots adapt dynamically using machine learning to optimize trades in real time.

What Is a Grid Bot?

A Grid Bot is built to profit from sideways markets by automating the process of buying low and selling high within a defined price range.

How It Works

The bot places multiple buy and sell orders at preset intervals (“the grid”). When the price dips below a grid level, it buys; when it rises above, it sells – locking in small but frequent profits.

Best For

- Range-bound or choppy markets.

- Traders looking for consistent, incremental returns.

Pros

- Captures profit from every price swing.

- Works automatically 24/7.

- Ideal for volatile, non-trending markets.

Cons

- Underperforms in strong trends.

- Requires proper grid spacing and stop-loss configuration.

What Is a DCA Bot?

The Dollar-Cost Averaging (DCA) Bot is a long-term investment tool. Instead of trying to time the market, it invests a fixed amount at regular intervals, lowering the average entry price over time.

How It Works

The bot automatically buys a chosen crypto asset daily, weekly, or monthly, regardless of price. Over time, this reduces the impact of short-term volatility.

Best For

- Long-term investors.

- Reducing emotional and timing risks.

Pros

- Smooths volatility.

- Simple to set and forget.

- Perfect for accumulation strategies.

Cons

- Limited in fast bull runs (misses some upside).

- Not suitable for short-term trading.

What Is an AI Bot?

AI Bots represent the next generation of crypto automation. They use machine learning, predictive analytics, and adaptive algorithms to analyze market data, detect trends, and make smart decisions in real time.

How It Works

AI Bots learn from historical data and live market inputs — constantly updating parameters to optimize performance. Unlike fixed-rule bots, they evolve as market conditions change.

Best For

- All market types (bullish, bearish, or sideways).

- Traders seeking automation with adaptive intelligence.

Pros

- Learns and improves over time.

- Adjusts to volatility and trend changes automatically.

- Can combine multiple strategies (DCA, grid, momentum, etc.).

Cons

- Requires more computational power.

- Dependent on data quality and AI model design.

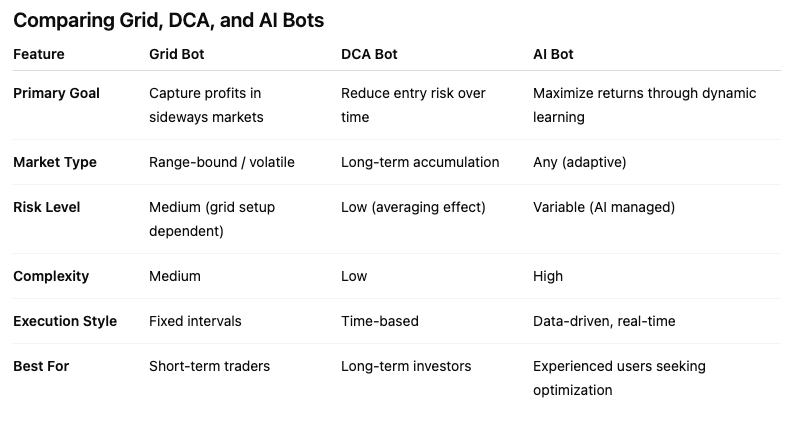

Which Bot Should You Choose?

The right bot depends on your trading style, risk tolerance, and market outlook:

- 🟩 Grid Bot: Best for traders who thrive in range markets.

- 🟦 DCA Bot: Ideal for investors building long-term portfolios.

- 🟨 AI Bot: Suited for adaptive, data-driven traders seeking maximum efficiency.

In practice, many professionals combine them — using DCA for accumulation, Grid Bots for volatility trading, and AI Bots to fine-tune risk and entry points automatically.

Final Thoughts: Smarter Automation With Junglebot

Junglebot integrates all three approaches into a unified platform, allowing traders to combine Grid, DCA, and AI intelligence to balance stability and performance. Whether you’re managing risk or hunting returns, Junglebot helps automate strategies with precision and consistency.

What Are Bull and Bear Markets? Simple Explanation for Crypto Traders