Imagine you are a spot crypto day trader

Every day, you execute trades based on your personal experience and knowledge. You start your trading session with a cup of coffee and in the right mental and physical state. This is a crucial step for any trader because you definitely don’t want to begin a session if you’re exhausted from the previous day or distracted by other important matters. In such cases, it’s better to skip the session than to make emotional decisions that could ruin your day.

You’re feeling great, and it’s game on.

You begin with a fundamental analysis of the global market. You check the latest news and current market performance from trusted sources. In crypto, every piece of news matters. The crypto market isn’t isolated – it reacts to movements in the broader financial world and to geopolitical developments. So, you roll up your sleeves and get ready.

You have many assets to choose from, but the decision isn’t easy due to the overwhelming number of options. Today, you focus on portfolio diversification. You search for undervalued assets and aim to build a balanced mix with varying levels of liquidity.

Next up: technical analysis.

It’s not realistic to analyze all 300+ assets on the exchange. So, you start with your shortlist – checking the overall trend, price momentum, oscillators, and support/resistance levels. You scan through candlestick patterns across different timeframes. Maybe you explore Renko, Kagi, or Heikin Ashi charts to better understand market structure. Naturally, you examine order book data for liquidity gaps, look for volume clustering, and analyze the volume profile to identify control points.

You have just 2–3 hours to make your decisions, based on notes in your trading journal.

Now it’s time to pick your strategy. Given the current conditions, you choose a conservative approach – the one that has historically delivered the best risk-to-reward ratio.

You decide to open positions in several promising assets. But what order type should you use? Market, Limit, or Stop-Limit? This is where liquidity becomes crucial. You choose Stop-Limit orders, defining your entry price, take profit, and stop-loss for each position.

With your orders placed, the waiting begins.

Rather than anxiously monitoring every asset, you take a break. Still, the thoughts begin to creep in – Did I set the right entry and exit? Is my stop-loss tight enough? Let’s assume your experience helps keep your emotions in check.

For the next few hours, you monitor the market and wait for your strategy to play out.

No matter the outcome, you’ll do it all again tomorrow.

This is your daily routine.

But what if there’s another way? The way of automated processes.

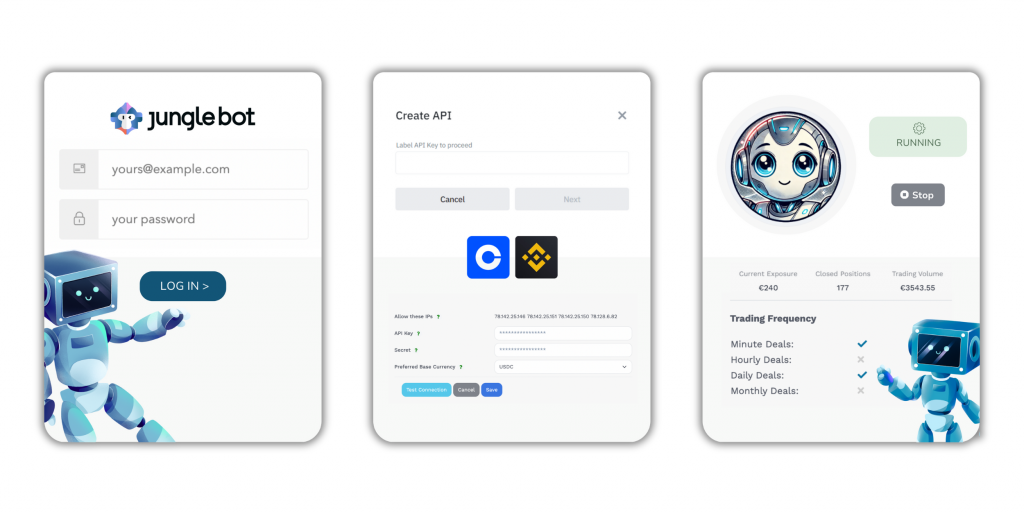

Process automation is becoming increasingly essential, especially in trading. This is where Junglebot comes in: an automated trading platform built specifically for the crypto market.

What’s the goal?

To provide a profitable seamless trading experience, allowing you to complete your entire daily routine in just four simple steps, freeing up valuable time for the things that truly matter – like your family and friends.

The technology behind Junglebot

At its core lies the principle of optimal entry timing. But first, let’s see how different types of traders can benefit from the platform.

Since market conditions and timeframes vary, Junglebot accommodates various trading styles, Scalping, Intra-day trading, and Swing trading.

With its user friendly interface, Junglebot offers flexible configuration for different Deal Types:

- Minute and Hourly deals → suited for scalping

- Daily and Monthly deals → suited for intra-day and swing trading

So no matter your strategy, Junglebot is adaptable.

What are the basic settings of the trading bot?

- Number of positions and exposure:

Setting the position exposure and number of deals has never been easier, just set the amount and the maximum number. That’s it.

- Sell Strategy:

Choose between Conservative or Adventurous sell strategies. This flexibility is especially useful for assessing performance during bull or bear markets.

- Deal Exploration:

In traditional finance, investments in bonds or stocks often involve a yield to maturity – the point at which returns are realized. Junglebot offers a similar feature: the Expiration Date. Think of it as the crypto-equivalent of a maturity term – when it’s reached, the position is closed.

The analytical core

Let’s say you have a hypothesis about a market outcome. You’d feel more confident if you had plenty of data to support it. But relying on a single instance – like flipping a coin once – only gives you a 50/50 chance. The more data you have, the better your predictions become.

This idea allows us to build confidence intervals, representing both best- and worst-case scenarios. By applying probability theory, we can adjust future assumptions based on past performance – giving you a statistical edge that aligns with best practices in data analysis.

Junglebot also incorporates well-known technical indicators like RSI, MACD, Moving Averages, the Hurst Exponent, and more.

But the real power lies in its AI core.

Advanced AI tools analyze, interpret, and rank assets based on both performance and current conditions. Entry decisions are guided by your target profit percentage, and the AI evaluates how likely it is for that goal to be achieved in the near term.

In simple terms

Junglebot follows a trend-following philosophy, backed by complex decision-making logic. It uses historical data to predict future movements while accounting for decision decay – the natural decline in a decision’s reliability as time passes and market conditions change.

In summary

Junglebot brings the sophistication of a professional trading system – built for both amateur and expert traders – while giving you more time to focus on what truly matters:

Your life beyond the charts.