Subscribe!

Stay updated on the latest trends,

exclusive offers, and helpful tips.

In modern financial theory, evaluating investment performance often extends beyond the traditional analysis […]

Before developing any profitable trading, forecasting, or signal-processing strategy, the analyst must first […]

In modern finance, it is often said that “risk is the price of […]

Uncovering how real-time liquidity and trader sentiment shape price formation beyond traditional chart […]

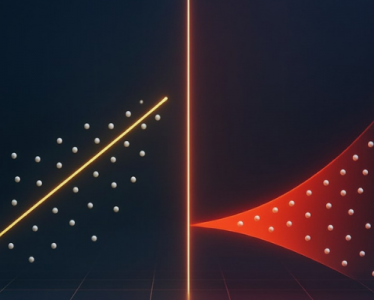

For econometrics and regression analysis, heteroskedasticity and homoskedasticity are two fundamental concepts every […]

Problem Description Many of us, at some point during our analysis of cryptocurrency […]

In statistical analysis and modeling, awareness of confidence intervals and detection of outliers […]

One of the most fundamental ideas in data science and analytics is data […]

As technology becomes a core component in strategic decision-making, the automation of investment […]

Liquidity pools power much of the decentralized finance (DeFi) ecosystem. They make it […]

Trading algorithms are designed to analyze markets faster and more accurately than any […]

In the era of crypto automation, many traders wonder whether running multiple bots […]

Stay updated on the latest trends,

exclusive offers, and helpful tips.