Trading crypto without testing your strategy first is like flying blind. The markets are volatile, 24/7, and unpredictable. Backtesting allows traders to simulate strategies on historical data, helping them understand potential performance, optimize risk, and build confidence before committing real capital.

In this article you will find out how backtesting evaluates how a trading strategy would have performed using historical price data. It helps identify strengths, weaknesses, and potential risks, ensuring traders are better prepared for live market conditions.

What Is Backtesting in Crypto?

Backtesting is the process of applying a trading strategy to historical data to evaluate how it would have performed. It is an essential step in strategy development because it reveals how your plan behaves under various market conditions.

Key Components:

- Historical Price Data: Daily, hourly, or minute-level data.

- Strategy Rules: Buy/sell signals, stop-loss, take-profit, position sizing.

- Performance Metrics: Profit/loss, drawdown, Sharpe ratio, win rate.

Why Backtesting Matters

- Assess Strategy Viability – it determines whether your strategy produces positive returns historically and filters out strategies that fail under real market conditions.

- Identify Weak Points – reveals drawdowns, losing streaks, and vulnerabilities in the plan and helps optimize entry/exit rules.

- Build Trader Confidence – shows expected performance range, reducing emotional decisions and supports realistic goal setting.

- Optimize Risk Management – helps fine-tune stop-loss, take-profit, and position sizing and prevents over-leverage and excessive exposure.

- Test Across Market Conditions – allows simulation in bullish, bearish, and sideways markets and ensures the strategy is robust and not curve-fitted to a single scenario.

How to Backtest a Crypto Strategy Step by Step

1. Gather Historical Data

-

Use reliable sources like Binance, Coinbase, or CoinMarketCap.

-

Choose the right timeframe (daily, 1-hour, 5-minute, depending on strategy).

2. Define Strategy Rules

-

Clearly state entry and exit conditions.

-

Include risk parameters like stop-loss, take-profit, and position size.

3. Simulate Trades

-

Apply the strategy to historical data.

-

Record outcomes for each trade (profit, loss, duration).

4. Analyze Performance Metrics

-

Total returns

-

Maximum drawdown

-

Win rate

-

Risk-adjusted measures (Sharpe Ratio, Omega Ratio)

5. Optimize and Iterate

-

Adjust parameters based on performance.

-

Re-test to validate improvements.

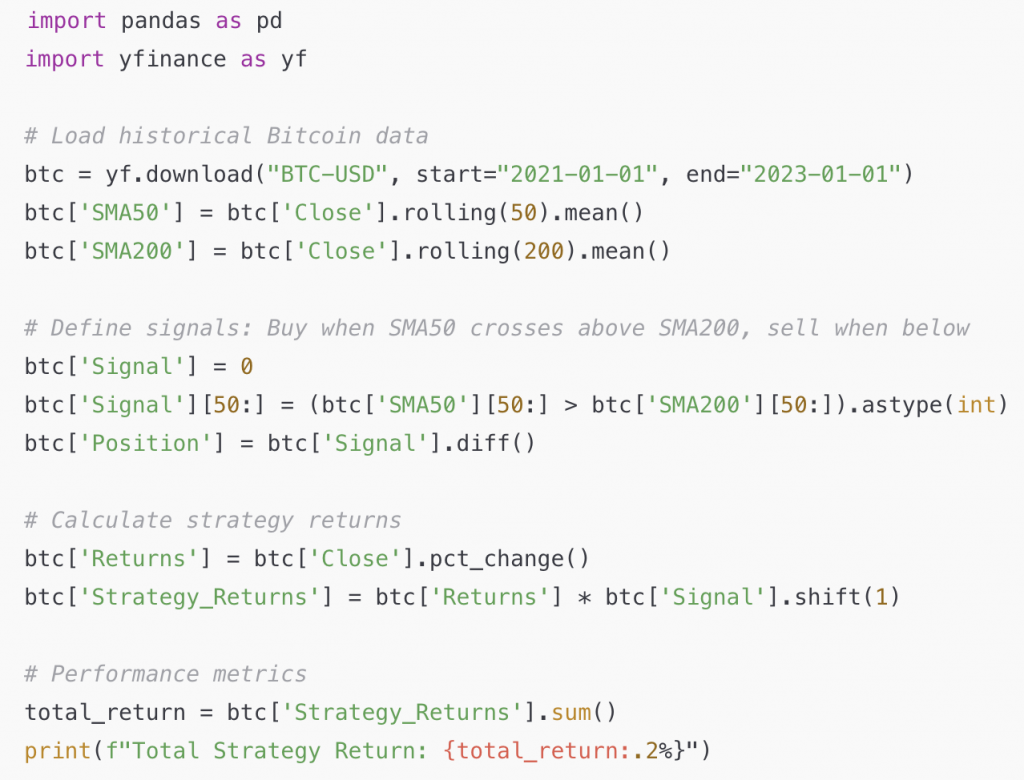

Python Example: Simple Moving Average (SMA) Strategy

This example shows a backtest of a simple SMA crossover strategy, giving a snapshot of historical performance before trading live.

Common Mistakes in Backtesting

- Using unrealistic assumptions: Ignoring fees, slippage, or liquidity constraints.

- Overfitting: Optimizing parameters to fit historical data too closely.

- Ignoring market conditions: Not testing across bull, bear, and sideways markets.

Final Thoughts: Backtesting Is Non-Negotiable

Backtesting is a critical step in crypto strategy development. It allows traders to understand risks, optimize rules, and gain confidence before committing real funds. Skipping this step increases the chance of emotional decisions, unexpected drawdowns, and underperformance in live trading.

RSI, MACD, and Moving Averages: Most Popular Crypto Indicators Explained