The crypto market runs 24/7, and so do AI trading bots. As digital assets evolve, AI-powered trading bots are reshaping how traders analyze data, manage risk, and execute strategies. These bots combine the precision of algorithms with the adaptability of machine learning, offering a glimpse into the future of fully automated, intelligent trading.

AI-powered trading bots analyze vast market data, detect patterns, and execute trades automatically. By learning and adapting to market conditions, they outperform traditional bots in speed, accuracy, and decision-making.

What Are AI-Powered Trading Bots?

Unlike traditional bots that follow static rules, AI bots use machine learning (ML) and data modeling to improve over time. They don’t just execute predefined signals, they learn from outcomes, optimize strategies, and adapt to changing market behavior.

Key Characteristics:

- Data-driven decisions using historical and live market inputs

- Pattern recognition beyond human capability

- Continuous learning and self-optimization

- Emotion-free execution based on logic, not bias

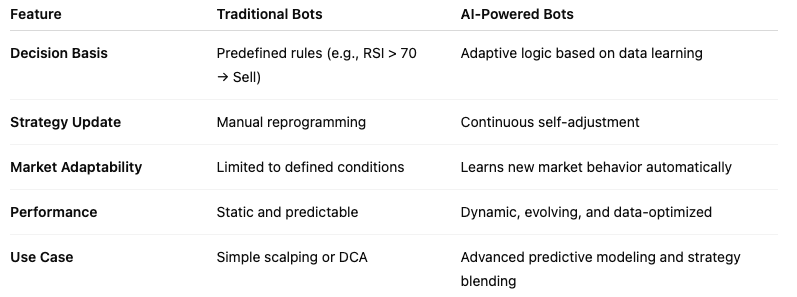

How AI Bots Differ from Traditional Bots

Traditional bots are great for consistent strategies like Grid or DCA, but they struggle when the market changes rapidly. AI bots, on the other hand, evolve – learning from every trade, trend, and anomaly.

How AI Bots Analyze the Market

AI bots combine multiple data sources and analytical models to make trading decisions:

- Market Data Feeds – Prices, volume, volatility metrics, and order books.

- Technical Indicators – RSI, MACD, moving averages, Bollinger Bands.

- Sentiment Analysis – Social media and news sentiment for behavioral insights.

- Machine Learning Models – Predictive algorithms trained on historical performance.

Example:

An AI bot might recognize a pattern between on-chain inflows, news sentiment, and BTC price drops, and preemptively short the market before retail traders react.

Benefits of AI in Crypto Trading

1. Adaptive to Market Conditions

AI bots learn from both bull and bear markets, identifying profitable conditions regardless of trend direction.

2. Reduced Emotional Bias

They eliminate FOMO, panic selling, and greed, executing trades purely based on logic.

3. 24/7 Optimization

AI continuously refines strategies, even while you sleep.

4. Enhanced Risk Management

Machine learning models analyze drawdowns and volatility, dynamically adjusting stop-loss or position size.

5. Predictive Capability

AI doesn’t just react, it anticipates. Predictive analytics identify probable future price movements before traditional indicators trigger.

Challenges and Considerations

- Data Quality: Poor or incomplete data leads to inaccurate predictions.

- Overfitting: AI may perform well historically but fail in live markets if not properly validated.

- Transparency: Many AI systems act as “black boxes,” making it hard to interpret decisions.

- Infrastructure Costs: Training and maintaining models require computational power.

Despite these challenges, the success rate of adaptive bots is steadily improving as technology advances.

The Future of AI Trading

The next generation of AI bots will likely integrate:

- Deep Reinforcement Learning (DRL): Allowing bots to “learn from experience.”

- On-chain AI Signals: Combining blockchain data with market sentiment.

- Hybrid Systems: Merging rule-based execution with AI-driven analysis for maximum stability.

With platforms like Junglebot, these advancements are no longer futuristic concepts, they’re already being deployed to optimize strategies, minimize risk, and capture real-time opportunities.

Final Thoughts: Automation Meets Intelligence

AI-powered trading bots represent the evolution of crypto automation, combining speed, logic, and adaptability. Traders who integrate AI into their workflow gain a competitive edge in execution, precision, and strategy development.

As crypto markets become more efficient, AI won’t just assist traders – it will define the future of trading itself.